|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Featured MNV Articles:

| Friday Sector Leaders: Energy, MaterialsBy Metals Channel Staff, Friday, March 5, 2:31 PM ET

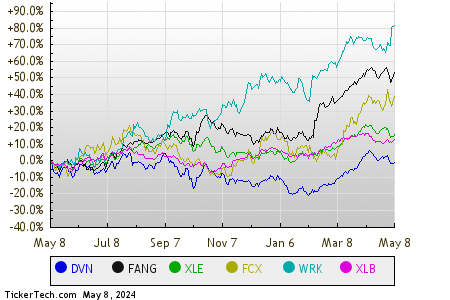

In afternoon trading on Friday, Energy stocks are the best performing sector, up 3.0%. Within the sector, Devon Energy Corp. (NYSE:DVN) and Diamondback Energy, Inc. (NASDAQ:FANG) are two of the day's stand-outs, showing a gain of 8.6% and 7.3%, respectively. Among energy ETFs, one ETF following the sector is the Energy Select Sector SPDR ETF (NYSE:XLE), which is up 2.8% on the day, and up 38.39% year-to-date. Devon Energy Corp., meanwhile, is up 62.18% year-to-date, and Diamondback Energy, Inc. is up 80.99% year-to-date. Combined, DVN and FANG make up approximately 2.9% of the underlying holdings of XLE. The next best performing sector is the Materials sector, higher by 1.7%. Among large Materials stocks, Freeport-McMoran Copper & Gold (NYSE:FCX) and WestRock Co (NYSE:WRK) are the most notable, showing a gain of 6.1% and 4.2%, respectively. One ETF closely tracking Materials stocks is the Materials Select Sector SPDR ETF (XLB), which is up 1.6% in midday trading, and up 3.36% on a year-to-date basis. Freeport-McMoran Copper & Gold, meanwhile, is up 33.36% year-to-date, and WestRock Co is up 16.33% year-to-date. Combined, FCX and WRK make up approximately 7.1% of the underlying holdings of XLB. Comparing these stocks and ETFs on a trailing twelve month basis, below is a relative stock price performance chart, with each of the symbols shown in a different color as labeled in the legend at the bottom: Here's a snapshot of how the S&P 500 components within the various sectors are faring in afternoon trading on Friday. As you can see, nine sectors are up on the day, while none of the sectors are down.

This Article's Word Cloud:

Among

Buying

Change

Combined

Communications

Comparing

Consumer

Copper

Corp

Devon

Diamondback

ETFs

Energy

FANG

Financial

Freeport

Friday

Gold

Healthcare

Here

Industrial

Insiders

Materials

McMoran

NYSE

Products

SPDR

Sector

Select

Services

WestRock

afternoon

approximately

basis

best

date

gain

holdings

make

meanwhile

performing

respectively

sector

sectors

showing

stocks

trading

underlying

which

year

|